Olympus published the latest financial report: There are two news:

- In the Imaging Business Olympus lost $500 million more than previously forecast

- The Imaging Business is now marked as “discontinued operation”

Our reader Mistral made a more deep analysis for us:

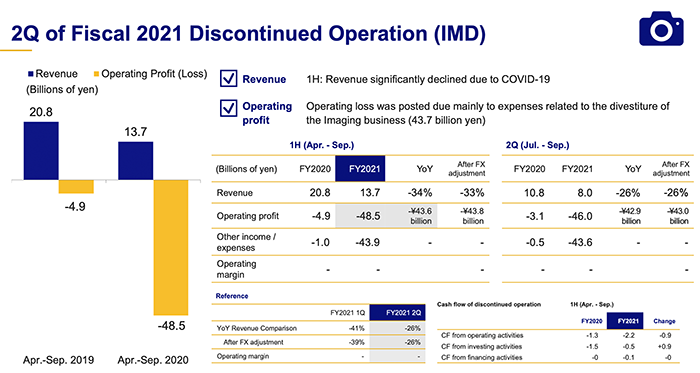

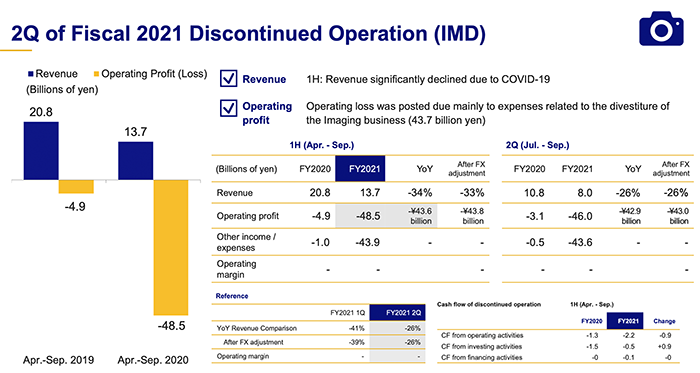

This business is soon to be divested and therefore accounted for as ‘discontinued operation’ (= not consolidated anymore) but they are still reporting the corresponding figures.

They recorded an operating loss of ¥46bn in Q2 (July – September) and ¥48.6bn in H1 (April – September) and forecast a total operating loss of ¥53bn ($500m) until divesting the business to JIP (thus meaning an additional ¥4.4bn in Q3).

All these pieces of information point at a severe downsize before the divestment.

- Headcount went down 30% in 6 months between 31 March 2020 (4,270 employees) and 30 September 2020 (3,031 employees). In Japan, less than 400 employees remain in the Imaging business.

- Between the first half of FY2020 and the first half of FY2021, capital expenditures (= investments) fell by half and R&D expenditures by 30%.

Q3 (October – December) business forecast is gloomy too:

- Revenue: ¥6.3bn, down more than 50% in comparison to the same quarter last year after -43% in Q1 and -26% in Q2 and in spite of the global economy recovering from Covid-19, in particular in Asia.

- Operating loss: ¥4.5bn = 72% of revenue, even though all one-off costs should have been recorded in the Q2 accounts.

I have trouble seeing how JIP could turn that thing around (make it profitable again) without deeply modifying the business model…