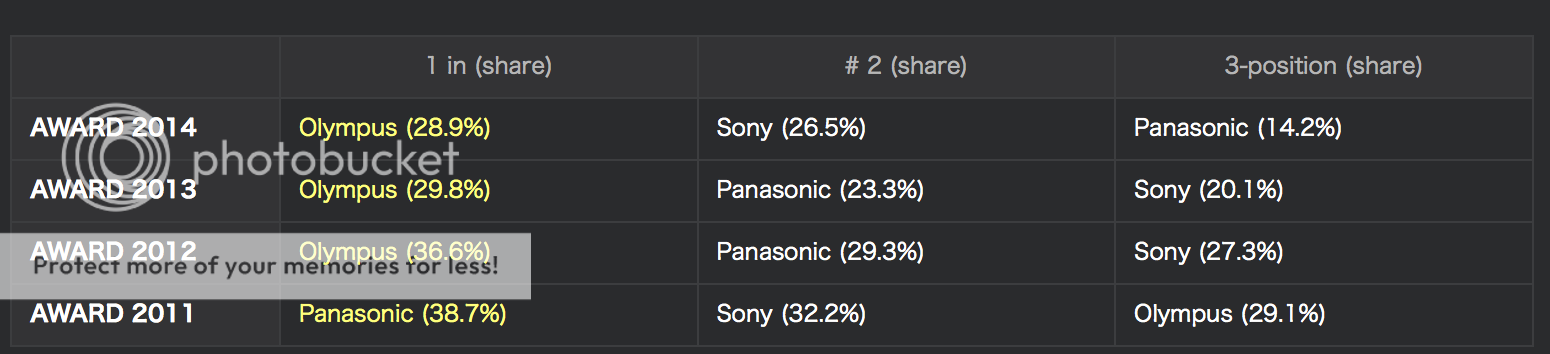

Olympus leads the mirrorless market in Japan. But Panasonic share drops.

BCNranking posted the market share numbers for 2013. As you can see from the graph on top Olympus still leads the mirrorless market although they lost 0.9% share compared to the previous year. Sony is now pretty close thanks to their A7-A7r cameras while Panasonic share dropped 9%!!!

I am curious to see what Panasonic will do to recover…