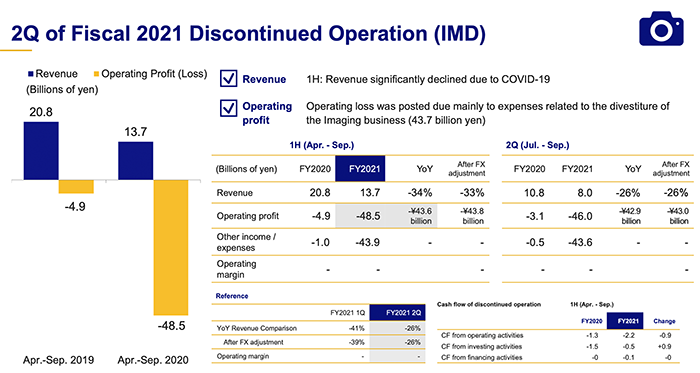

Olympus publishes the new financial report: Imaging Business lost more money than expected

Olympus published the latest financial report: There are two news:

- In the Imaging Business Olympus lost $500 million more than previously forecast

- The Imaging Business is now marked as “discontinued operation”

Our reader Mistral made a more deep analysis for us:

All these pieces of information point at a severe downsize before the divestment.

- Headcount went down 30% in 6 months between 31 March 2020 (4,270 employees) and 30 September 2020 (3,031 employees). In Japan, less than 400 employees remain in the Imaging business.

- Between the first half of FY2020 and the first half of FY2021, capital expenditures (= investments) fell by half and R&D expenditures by 30%.

- Revenue: ¥6.3bn, down more than 50% in comparison to the same quarter last year after -43% in Q1 and -26% in Q2 and in spite of the global economy recovering from Covid-19, in particular in Asia.

- Operating loss: ¥4.5bn = 72% of revenue, even though all one-off costs should have been recorded in the Q2 accounts.