(Reuters) – Japanese group Olympus Corporation is aiming for its small, lightweight models to have 20 percent of the high-end digital camera market in three years, up from 5 percent now, its president said.

The camera and endoscope maker is also targeting 500-600 billion yen ($5.7-$6.8 billion) sales of medical gear in five years, Tsuyoshi Kikukawa told Reuters on Thursday, in a glimpse of a mid-term business plan due out in May.

That medical sales target compared to an estimated 345 billion yen for the year to end-March.

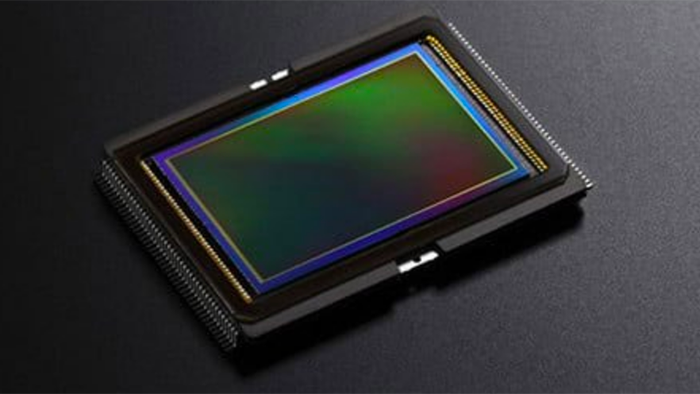

Last year, Olympus launched cameras based on the Micro FourThirds System which helps makes smaller high-end cameras with interchangeable lenses, targeting those reluctant to trade compact cameras for bulkier and heavier models.

Digital cameras with interchangeable lenses are the most lucrative and fastest-growing portion of the global camera industry, a segment that has been dominated by Canon Inc and Nikon Corp.

Canon and Nikon managed to carry their popularity in the film camera era into the digital age partly because lenses for their respective film cameras were compatible only with their digital cameras, prompting customers to stick to one brand.

“Now a considerable number of compact camera users are moving up to higher-end models. Not many of them bought Canon or Nikon’s high-end models in the film age. For these people, being lighter and smaller means a lot,” Kikukawa said. “It can be a real hassle to carry around a big camera and lenses.”

Panasonic launched digital cameras based on the Micro FourThirds System in 2008, followed by Olympus in 2009, and now such cameras account for 20 percent of high-end camera demand in Japan, Olympus said.

Kikukawa, who took the helm at Olympus in 2001, said he aimed to bring the camera division’s operating profit margin to at least 10 percent in five years, compared with an estimated 2.8 percent in 2009-10.

“Growth in high-end camera sales comes with growth in sales of lenses and accessories, which are also high-margin products,” he said. “We need to hit a 10 percent margin in five years at the latest. Otherwise, it would not make a lot of sense for us to stay in the business.”

He aims to boost overall sales at Olympus to 1.5 trillion yen in five years from an estimated 900 billion yen this year, and to lift operating profit to at least 100 billion yen from a forecast 59 billion for 2009-10.

Olympus, the world’s fourth-largest maker of high-end cameras behind Canon, Nikon and Sony Corp, is the No.1 maker of endoscopes used to examine internal organs with a global market share of about 70 percent. Smaller rivals include Hoya Corp and Fujifilm Holdings.

It aims to boost revenue at the medical equipment division to 500-600 billion yen by 2014-15 by driving sales in emerging markets such as China and India, Kikukawa said.

(Reporting by Kiyoshi Takenaka; Editing by Chris Gallagher and Dan Lalor)

/ Adorama / BH

Redcoon Deutschland

Redcoon Italia